Part-time real estate agent is an option for people who want to earn money while also working in a traditional job. This is a great way to earn extra money while also saving for your retirement. As a real-estate agent, you can meet new people and work in your community.

Best brokerage for part time agents

You need a realty brokerage that supports you and provides training to help grow your realty business. A brokerage that supports you in building your influence and has an experienced mentor to help you navigate the difficult start-up phase.

There are many brokerages you can choose from. Finding the right one can be challenging. Here are the best brokerages to help you become a part-time agent in real estate.

Fathom Realty

Fathom is the top cloud-based and agent-friendly real-estate broker, which is perfect for part-time professionals in real estate. Fathom offers outstanding training programs for their agents. They also offer live, interactive coaching. In addition to their comprehensive training programs, they have a revenue sharing model that allows agents to keep around 80% of their commissions.

eXp Realty

eXp, another brokerage, is ideal for part time real estate agents. Cloud-based systems make it easy for you to manage your company from anywhere. Their revenue sharing model lets you build retirement income while your realty business grows.

Join a team of agents: For part-time real estate agents, joining a real estate team is a great option because it allows you to get a continuous flow of leads from the other members on your team. To grow your business in real estate, you can also use the experience and expertise your team members.

Create a plan for lead generation

To be successful as a part time real estate agent, you need to create a strategy for generating leads and building relationships with prospective clients. An effective and efficient lead generation strategy is key to whether or not your realty business succeeds.

A good real estate lead generation plan should focus on developing relationships with potential clients through social media, email, and paid ads through platforms like Market Leader or Zillow. These tools can help connect with your target audiences, increase your influence and convert those leads to sales.

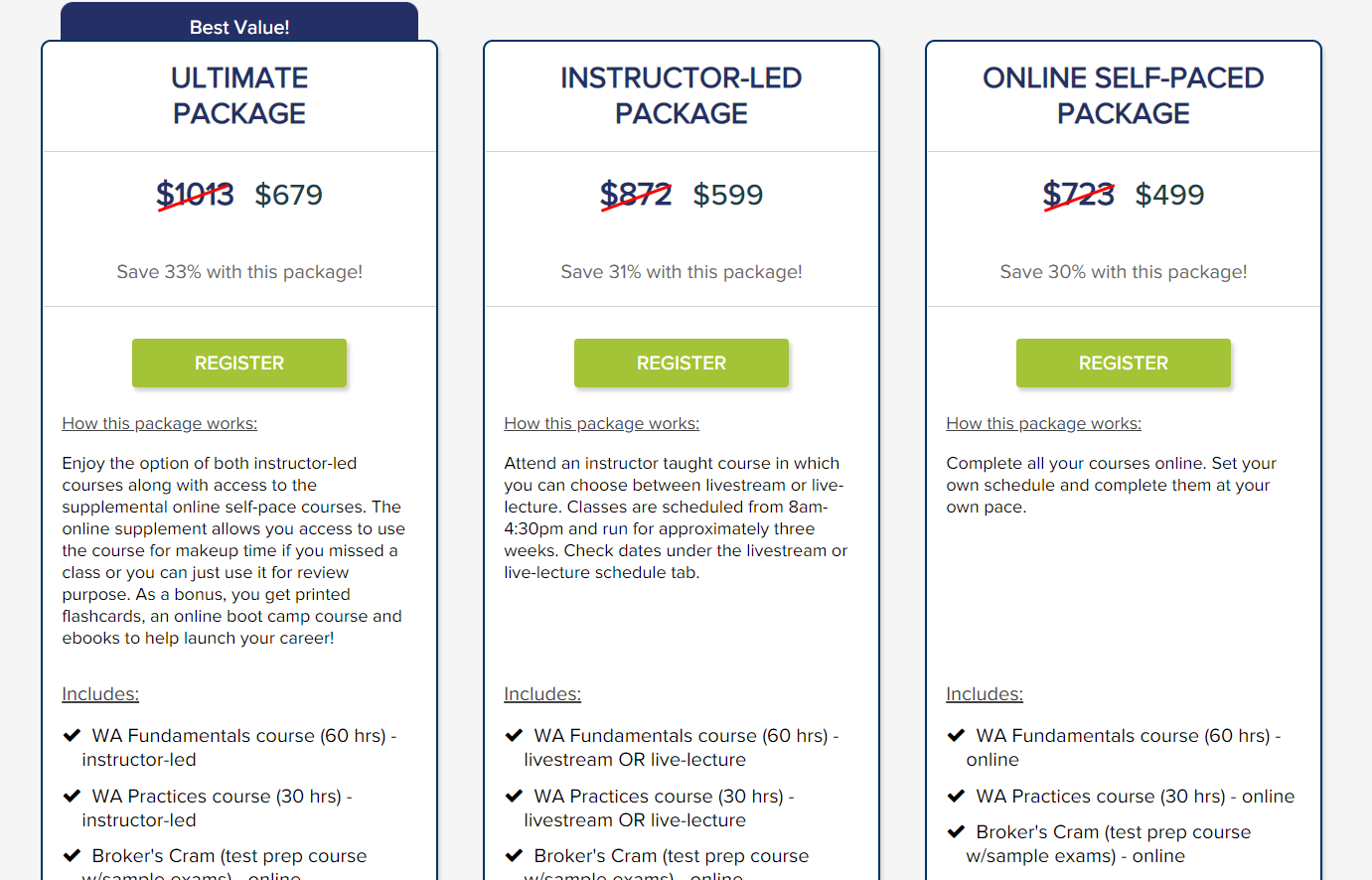

Pre-Licensing and Licensing Education

A license is necessary before you are allowed to sell real estate. Every state has their own requirements. Make sure you look into the licensing and pre-licensing options in your region.

To become a full-time agent, you will need to obtain your real estate license. You can take the real estate exam or online courses to get your real estate license.

It is hard work and can seem daunting to get your real-estate license. However, if you are committed and have the right attitude, it can be a rewarding career option.

FAQ

What amount should I save to buy a house?

It all depends on how long your plan to stay there. If you want to stay for at least five years, you must start saving now. But, if your goal is to move within the next two-years, you don’t have to be too concerned.

How much does it cost to replace windows?

Windows replacement can be as expensive as $1,500-$3,000 each. The cost to replace all your windows depends on their size, style and brand.

What should I look out for in a mortgage broker

Mortgage brokers help people who may not be eligible for traditional mortgages. They look through different lenders to find the best deal. Some brokers charge a fee for this service. Other brokers offer no-cost services.

What are the benefits to a fixed-rate mortgage

A fixed-rate mortgage locks in your interest rate for the term of the loan. This ensures that you don't have to worry if interest rates rise. Fixed-rate loans have lower monthly payments, because they are locked in for a specific term.

How many times may I refinance my home mortgage?

It depends on whether you're refinancing with another lender, or using a broker to help you find a mortgage. Refinances are usually allowed once every five years in both cases.

How long does it take for a mortgage to be approved?

It depends on many factors like credit score, income, type of loan, etc. It typically takes 30 days for a mortgage to be approved.

Do I need flood insurance?

Flood Insurance protects from flood-related damage. Flood insurance helps protect your belongings and your mortgage payments. Find out more information on flood insurance.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

How to Find an Apartment

When moving to a new area, the first step is finding an apartment. Planning and research are necessary for this process. This includes researching the neighborhood, reviewing reviews, and making phone call. While there are many options, some methods are easier than others. These are the steps to follow before you rent an apartment.

-

You can gather data offline as well as online to research your neighborhood. Online resources include websites such as Yelp, Zillow, Trulia, Realtor.com, etc. Local newspapers, real estate agents and landlords are all offline sources.

-

Read reviews of the area you want to live in. Yelp. TripAdvisor. Amazon.com have detailed reviews about houses and apartments. Local newspaper articles can be found in the library.

-

For more information, make phone calls and speak with people who have lived in the area. Ask them about their experiences with the area. Also, ask if anyone has any recommendations for good places to live.

-

You should consider the rent costs in the area you are interested. If you think you'll spend most of your money on food, consider renting somewhere cheaper. You might also consider moving to a more luxurious location if entertainment is your main focus.

-

Find out more information about the apartment building you want to live in. What size is it? What's the price? Is it pet friendly? What amenities are there? Are you able to park in the vicinity? Do you have any special rules applicable to tenants?