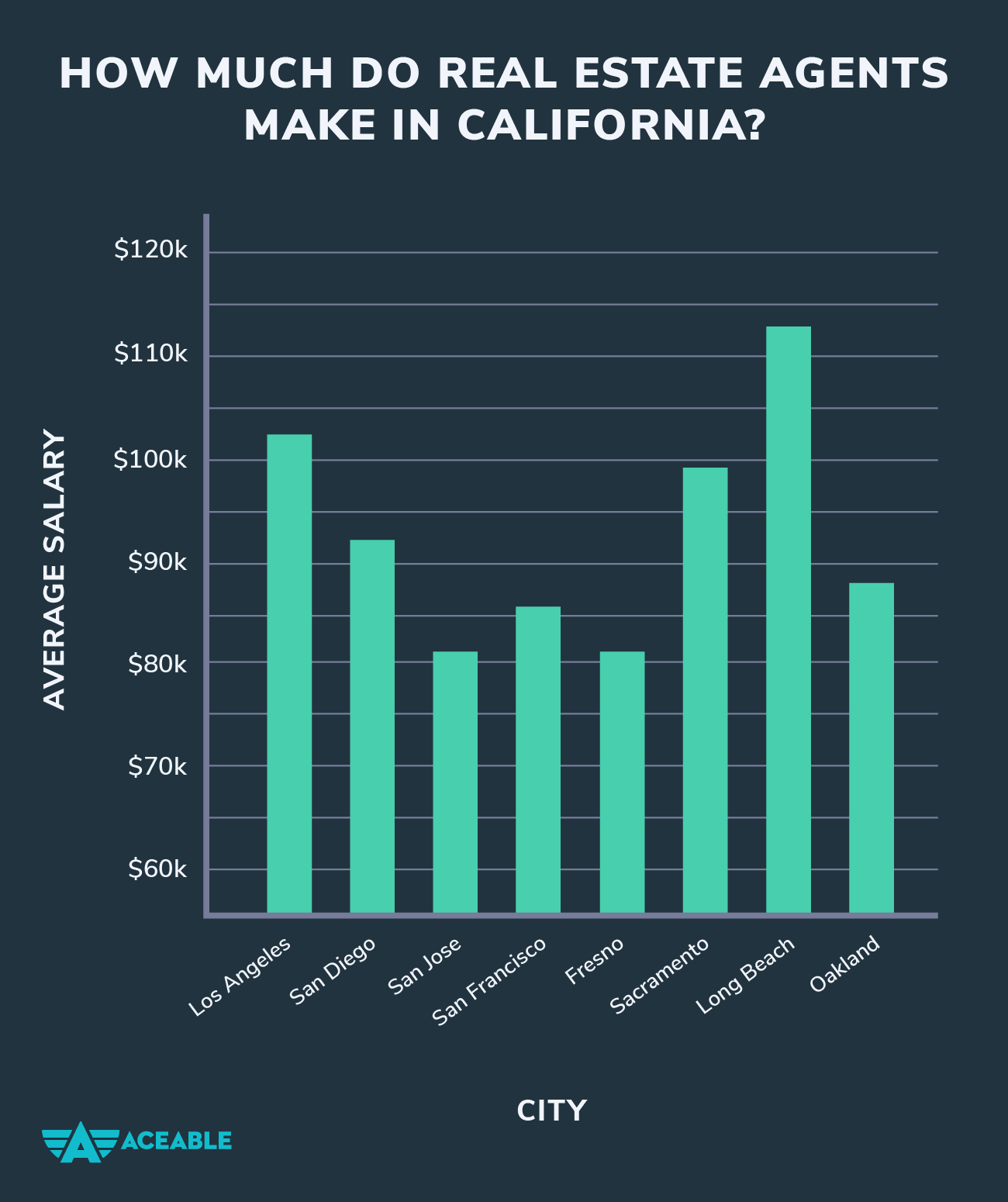

Start your real estate career to have a positive influence on the lives of others and secure a financial future. You can also take charge of your own life and choose the hours you work.

Before you start selling real property, you will need to become licensed, gain some experience, and create a business plan. It's not always easy to get started in realty, but the effort is worth it.

1. Understand the Industry

The real estate industry is highly competitive, so you should learn as much as you can about it before beginning your career. If you want to become a real estate agent or broker, you will need to be familiar with the market you'll work in so you can provide the best service for your clients.

2. Prepare for Success

Create a realistic business strategy and set goals both for yourself and for your agency. Your marketing strategy will be determined, as well as your target client. Also, you'll have to come up with an unique value proposition which sets you apart.

3. Build Your Network

In real estate, there is a lot of collaboration. Therefore, it's essential to create a strong team that can assist you in reaching your goals. This team should include real estate agents or brokers, mortgage loan officers, appraisers attorneys, and any other professionals you might need to collaborate with in order to complete the deal.

4. Have a Clear Vision of Your Goals

To be successful in real estate, you need to have a vision of what your life will look like. You need to include both your short-term goals as well as what you expect to achieve over the next few years.

5. Make a schedule

The flexibility of a career in real estate is appealing, but it's also important to cultivate discipline and keep an eye on your workload. This means creating a weekly checklist, planning your week or month in advance, and finding ways to balance your business activities with your personal life.

6. Develop Your Sales Mindset

Real estate is a career where a strong sales mindset can be crucial. It allows you to listen to the needs of your buyers and find solutions.

Listen to podcasts on sales or read sales books if you need help developing your sales mind-set. They'll teach you all about how to best present yourself and communicate with your potential clients, so you can deliver a great experience for them every time.

7. Hire an Assistant

It's worth investing in a personal assistant because they can save you so much time. If you don’t have a Personal Assistant, you can get one for less than 100 dollars per month.

FAQ

How much money can I get to buy my house?

It all depends on several factors, including the condition of your home as well as how long it has been listed on the market. Zillow.com says that the average selling cost for a US house is $203,000 This

How long does it take to sell my home?

It all depends on several factors such as the condition of your house, the number and availability of comparable homes for sale in your area, the demand for your type of home, local housing market conditions, and so forth. It can take anywhere from 7 to 90 days, depending on the factors.

Is it possible to sell a house fast?

If you plan to move out of your current residence within the next few months, it may be possible to sell your house quickly. But there are some important things you need to know before selling your house. First, find a buyer for your house and then negotiate a contract. Second, you need to prepare your house for sale. Third, it is important to market your property. You should also be open to accepting offers.

How much does it take to replace windows?

Replacing windows costs between $1,500-$3,000 per window. The cost to replace all your windows depends on their size, style and brand.

How do I calculate my rate of interest?

Market conditions impact the rates of interest. In the last week, the average interest rate was 4.39%. Divide the length of your loan by the interest rates to calculate your interest rate. For example: If you finance $200,000 over 20 year at 5% per annum, your interest rates are 0.05 x 20% 1% which equals ten base points.

Can I buy a house without having a down payment?

Yes! Yes. These programs include FHA loans, VA loans. USDA loans and conventional mortgages. Check out our website for additional information.

How long does it take for a mortgage to be approved?

It depends on many factors like credit score, income, type of loan, etc. It typically takes 30 days for a mortgage to be approved.

Statistics

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

How to find houses to rent

People who are looking to move to new areas will find it difficult to find houses to rent. It may take time to find the right house. When you are looking for a home, many factors will affect your decision-making process. These factors include size, amenities, price range, location and many others.

You should start looking at properties early to make sure that you get the best price. Also, ask your friends, family, landlords, real-estate agents, and property mangers for recommendations. This will allow you to have many choices.