If you're interested in becoming a real estate agent, you need to start with the right education. There are many options available, including online and in-person real estate schools. Each one has its own set of pros and cons, so it's important to choose the one that best suits your learning style.

Real Estate Classes Oklahoma

Pre-licensing education is required for Oklahoma realty agents. You will need to complete 90 hours. It may seem like a lot but it is not if you are taking your course online.

There are many options so that you can find an online school that is convenient for you and your budget. The top ranked schools offer a variety of pre-licensing courses as well as post-licensing courses and continuing education.

McKissock is a credible online real estate school that offers state-approved CE courses in addition to their real estate license preparation course. The school has a high passing rate, and they offer a refund policy of up to 10 days if it isn't for you.

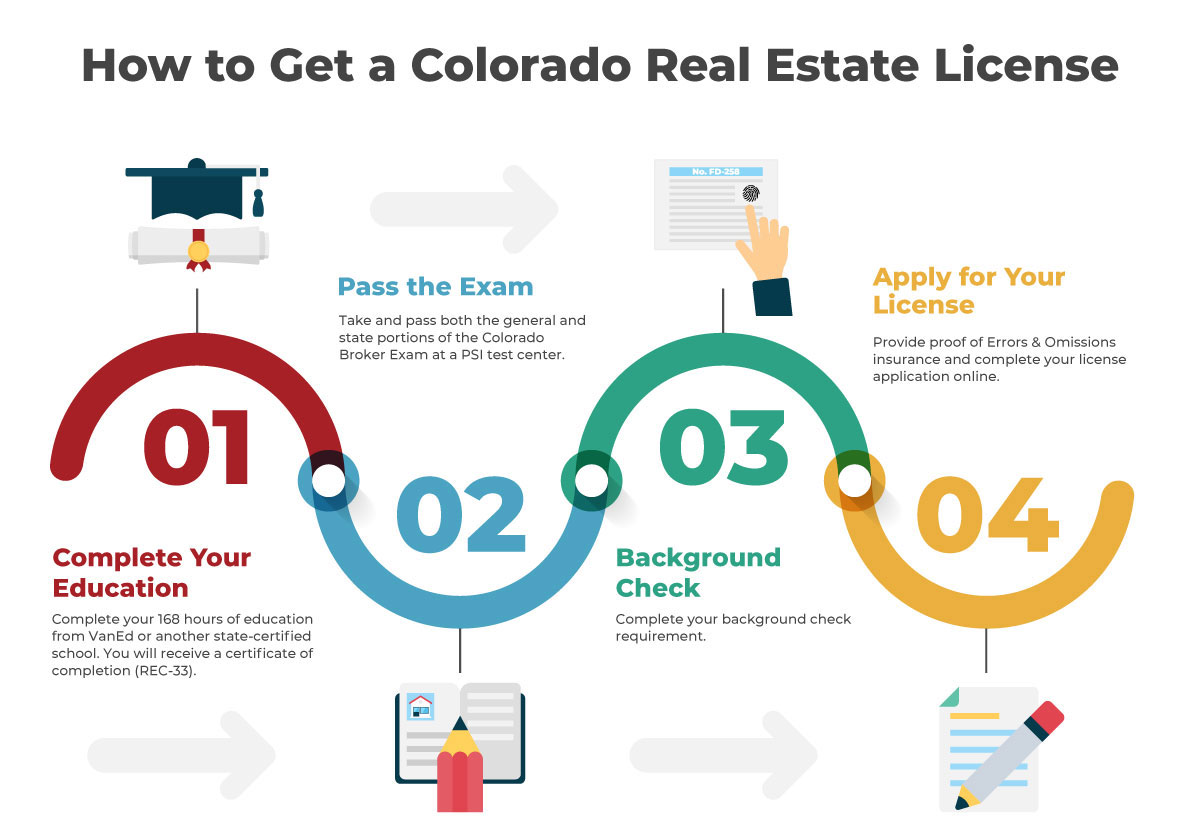

VanEd, a highly rated real estate school, has been around for over 23 years. It has a strong reputation for providing quality courses. They have a variety of course packages that include exam prep courses, study aids, and live instructor support.

Access to a digital flashcard library, a personal academic advisor and a glossary on real estate are all available. You can also get a refund within 72 hours for online courses.

Students in Oklahoma love Colibri Real Estate for their real-estate license preparation courses. They have a high student success rate, great reviews from past students, as well as being very budget-friendly. You can also get a pass or no-pay guarantee for your exam preparation and prelicensing courses. This is particularly helpful for those who are new to the industry.

Kevo University is a self paced real estate school. It has been approved and offered online pre-licensing classes. You can also take classes online and in person.

Barnes Real Estate School, a school that teaches real estate classes in Oklahoma City, is another good choice. You can choose from a variety of courses that are available on the weekends, weekdays, mornings, or evenings. The classes are interactive and engaging, which makes them a great option for people who prefer classroom learning.

Burroughs Real Estate School is another excellent choice for people looking for a traditional classroom school in real estate. This school is known for its engaging instructors and offers different schedules, including night and weekend classes.

The basic package is $377, which includes the course, instructor support, three real estate eBooks, and an exam prep course. They also offer instructor support and a pass, or don't worry guarantee.

The best online real-estate schools offer flexible learning and self-paced learning. Most offer a money-back guarantee and are easy to use. You can also find a range of real estate exam prep courses as well as digital flashcards so that you can learn at your own speed.

FAQ

What are the three most important things to consider when purchasing a house

The three main factors in any home purchase are location, price, size. Location refers to where you want to live. Price refers to what you're willing to pay for the property. Size refers to the space that you need.

Are flood insurance necessary?

Flood Insurance protects against damage caused by flooding. Flood insurance protects your belongings and helps you to pay your mortgage. Find out more information on flood insurance.

What should I do if I want to use a mortgage broker

A mortgage broker is a good choice if you're looking for a low rate. Brokers have relationships with many lenders and can negotiate for your benefit. Some brokers do take a commission from lenders. Before you sign up for a broker, make sure to check all fees.

What amount of money can I get for my house?

The number of days your home has been on market and its condition can have an impact on how much it sells. According to Zillow.com, the average home selling price in the US is $203,000 This

Can I get another mortgage?

Yes. But it's wise to talk to a professional before making a decision about whether or not you want one. A second mortgage can be used to consolidate debts or for home improvements.

What are the benefits associated with a fixed mortgage rate?

Fixed-rate mortgages allow you to lock in the interest rate throughout the loan's term. This will ensure that there are no rising interest rates. Fixed-rate loans have lower monthly payments, because they are locked in for a specific term.

What should you consider when investing in real estate?

It is important to ensure that you have enough money in order to invest your money in real estate. If you don’t save enough money, you will have to borrow money at a bank. It is important to avoid getting into debt as you may not be able pay the loan back if you default.

You also need to make sure that you know how much you can spend on an investment property each month. This amount must include all expenses associated with owning the property such as mortgage payments, insurance, maintenance, and taxes.

You must also ensure that your investment property is secure. It would be best to look at properties while you are away.

Statistics

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

External Links

How To

How to Manage A Rental Property

While renting your home can make you extra money, there are many things that you should think about before making the decision. We'll show you what to consider when deciding whether to rent your home and give you tips on managing a rental property.

This is the place to start if you are thinking about renting out your home.

-

What should I consider first? Take a look at your financial situation before you decide whether you want to rent your house. If you are in debt, such as mortgage or credit card payments, it may be difficult to pay another person to live in your home while on vacation. You should also check your budget - if you don't have enough money to cover your monthly expenses (rent, utilities, insurance, etc. It might not be worth the effort.

-

How much does it cost to rent my home? There are many factors that influence the price you might charge for renting out your home. These include things like location, size, features, condition, and even the season. Remember that prices can vary depending on where your live so you shouldn't expect to receive the same rate anywhere. Rightmove has found that the average rent price for a London one-bedroom apartment is PS1,400 per mo. This means that if you rent out your entire home, you'd earn around PS2,800 a year. While this isn't bad, if only you wanted to rent out a small portion of your house, you could make much more.

-

Is it worth the risk? There are always risks when you do something new. However, it can bring in additional income. Before you sign anything, though, make sure you understand exactly what you're getting yourself into. Not only will you be spending more time away than your family, but you will also have to maintain the property, pay for repairs and keep it clean. You should make sure that you have thoroughly considered all aspects before you sign on!

-

Is there any benefit? It's clear that renting out your home is expensive. But, you want to look at the potential benefits. There are plenty of reasons to rent out your home: you could use the money to pay off debt, invest in a holiday, save for a rainy day, or simply enjoy having a break from your everyday life. Whatever you choose, it's likely to be better than working every day. If you plan ahead, rent could be your full-time job.

-

How can I find tenants Once you've made the decision that you want your property to be rented out, you must advertise it correctly. Make sure to list your property online via websites such as Rightmove. Once potential tenants contact you, you'll need to arrange an interview. This will enable you to evaluate their suitability and verify that they are financially stable enough for you to rent your home.

-

How can I make sure I'm covered? You should make sure your home is fully insured against theft, fire, and damage. Your landlord will require you to insure your house. You can also do this directly with an insurance company. Your landlord will often require you to add them to your policy as an additional insured. This means that they'll pay for damages to your property while you're not there. If your landlord is not registered with UK insurers, or you are living abroad, this policy doesn't apply. In these cases, you'll need an international insurer to register.

-

If you work outside of your home, it might seem like you don't have enough money to spend hours looking for tenants. You must put your best foot forward when advertising property. A professional-looking website is essential. You can also post ads online in local newspapers or magazines. You'll also need to prepare a thorough application form and provide references. Some people prefer to do everything themselves while others hire agents who will take care of all the details. Interviews will require you to be prepared for any questions.

-

What happens once I find my tenant If you have a current lease in place you'll need inform your tenant about changes, such moving dates. You can negotiate details such as the deposit and length of stay. You should remember that although you may be paid after the tenancy ends, you still need money for utilities.

-

How do I collect my rent? You will need to verify that your tenant has actually paid the rent when it comes time to collect it. If your tenant has not paid, you will need to remind them. Any outstanding rents can be deducted from future rents, before you send them a final bill. You can call the police if you are having trouble getting hold of your tenant. They won't normally evict someone unless there's been a breach of contract, but they can issue a warrant if necessary.

-

How can I avoid potential problems? It can be very lucrative to rent out your home, but it is important to protect yourself. Install smoke alarms, carbon monoxide detectors, and security cameras. Make sure your neighbors have given you permission to leave your property unlocked overnight and that you have enough insurance. You should never allow strangers into your home, no matter how they claim to be moving in.